Software Applications Face A New Intermediary

Operating System AI Agent versus Foundation Model AI Agent.

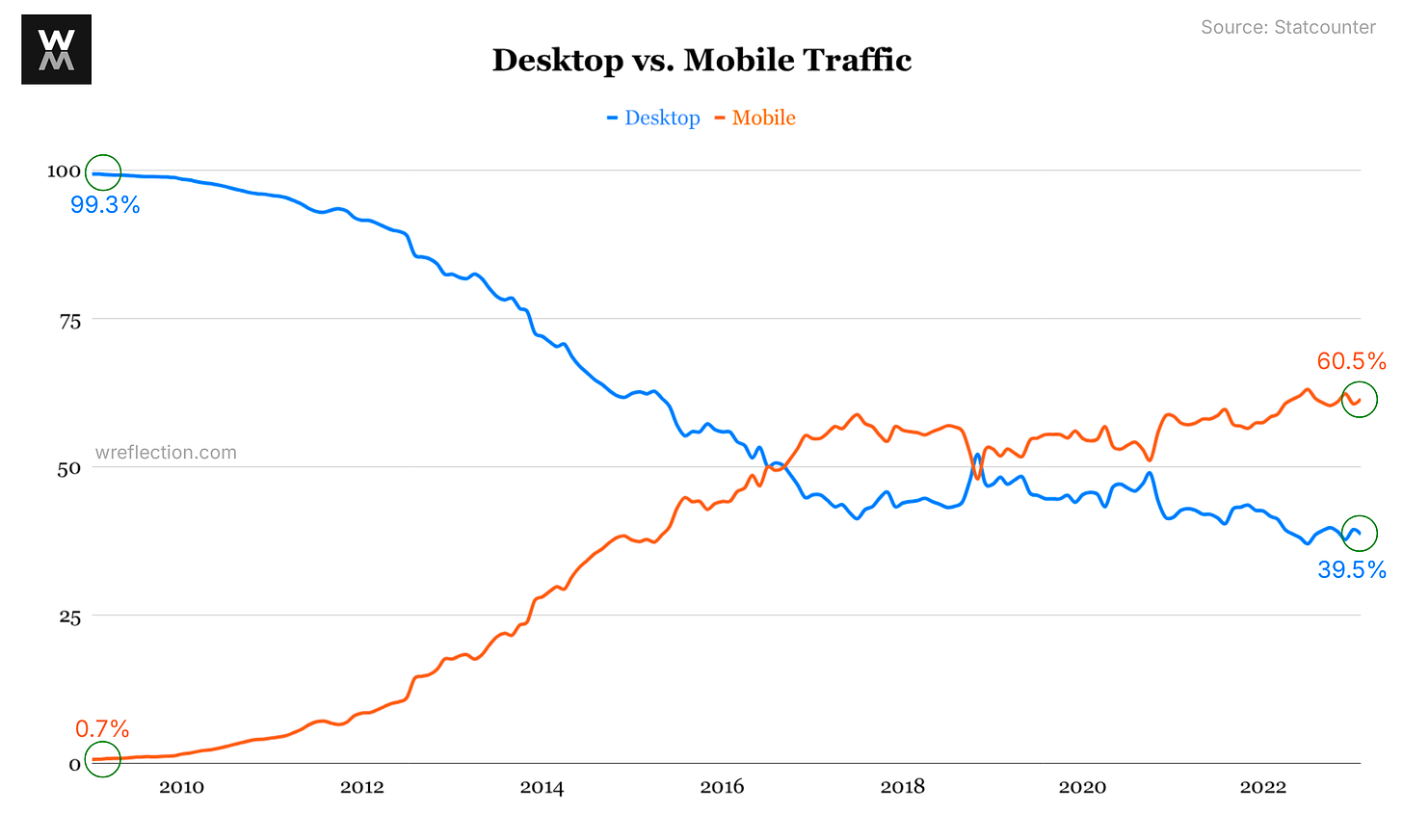

In 2009, Amazon’s leadership team noticed an unmistakable trend in their monthly business reviews (MBR). Mobile traffic to Amazon’s websites was increasing rapidly and, if the trend continued, would one day overtake desktop traffic (it eventually did in 2016).

The year prior, Apple had opened the iPhone to third-party developers, and Amazon had launched two apps on the App Store: a shopping app that let customers browse and buy physical products from Amazon’s e-commerce store, and a Kindle app where users could read ebooks but could not buy them. Apple’s 30% commission on in-app digital purchases meant Amazon couldn’t afford to sell ebooks or digital music/video through its iOS apps (see footnote for more context on Amazon’s digital business economics1).

The traffic trend exposed a risk. Mobile would become the primary shopping channel, and if Apple decided to expand its take rate to physical goods (say 1-2% or so like credit card interchange fees), Amazon’s entire retail business would face the App Store tax, not just the digital business. In response2, Amazon started a new personal device project in 2010. From Fast Company:

The project, code-named “Tyto” for a genus of owl, got rolling in 2010. Customers often come to Amazon via iPhones or Android devices. Not controlling the hardware can create problems. For instance, you can’t buy e-books through the Kindle app on your iPhone because Apple takes 30% of app-driven sales—a cut that would hurt Amazon’s already razor-thin margin.

This device (Fire Phone) flopped, but the strategic concern that motivated it was valid. Mobile Operating Systems (OS) had inserted themselves as the new layer between users and applications, dictated what apps could and could not do3, and imposed significant transaction fees.

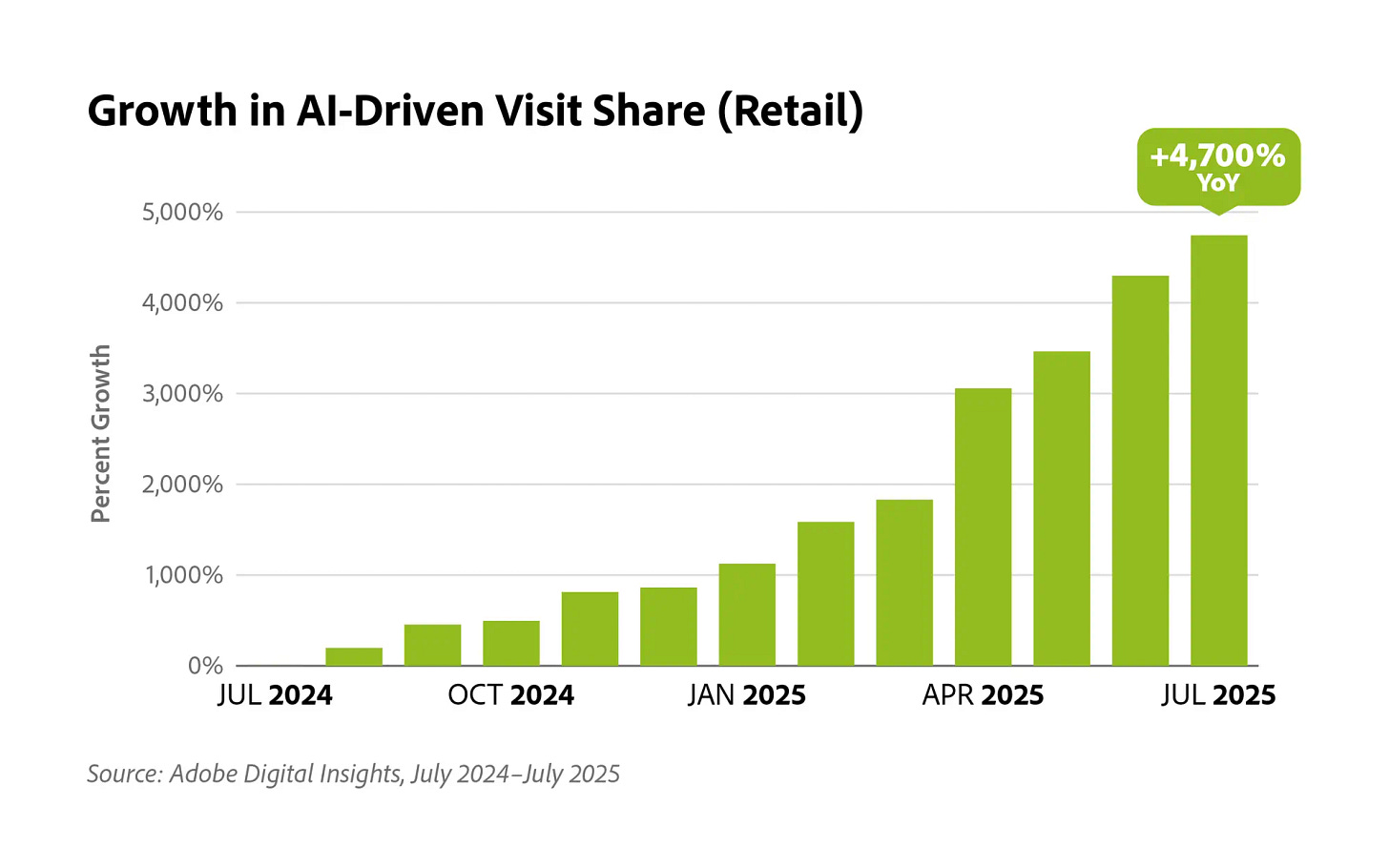

Today, AI is emerging as another new layer.

The AI Agent Layer

Players from both up and down the stack want to own this new layer.

Application AI Agent. ChatGPT, Google Gemini, Perplexity etc. are building browsing and shopping AI agents into their apps that sit between users and other apps. OpenAI announced its Instant Checkout feature in September 2025, initially with Etsy and Shopify, followed quickly by Walmart and Target4. Amazon has notably stayed out of this partnership. But when Perplexity launched its AI browser Comet that lets users browse shopping websites using Perplexity’s AI agent, Amazon blocked Comet’s access and sent a cease-and-desist letter. I am skeptical of current AI chatbot shopping experiences5, but the public dispute between the two shows that neither wants to cede control of the user interaction.

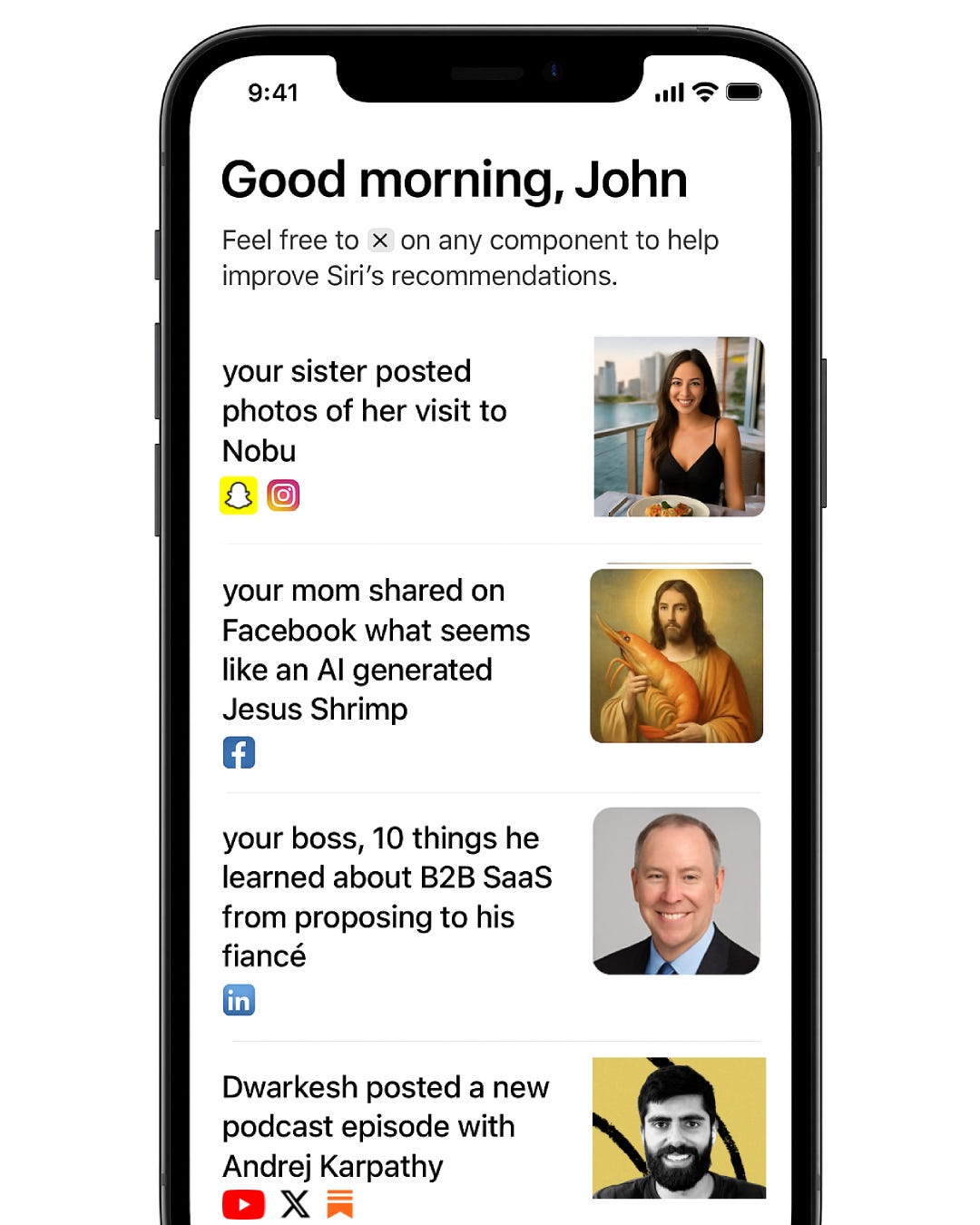

Operating System AI Agent. Apple Intelligence and Google’s Gemini Android integration represent attempts to make AI a native OS capability. For example, Apple’s App Intents framework is trying to create structured ways for the OS AI to interact with applications.

The App Intents framework provides functionality to deeply integrate your app’s actions and content with system experiences. With Apple Intelligence, Siri will suggest your app’s actions to help people discover your app’s features and gains the ability to take actions in and across apps.

The vision is that when you ask Siri to “order dinner,”6 the OS AI compares across multiple apps (such as DoorDash or Uber Eats), shows you the options (including which ones have discounts), handles the back-and-forth, and completes the transaction. The user may never open some apps directly7. Eventually, the OS AI layer, in addition to coordination and orchestration, might even generate a custom UI across different apps if required.

Applications from foundation models have the technological advantages.

Their models are more capable.

They have built dedicated AI infrastructure, from physical resources like compute and power access to operational systems that serve models with low latency.

They have accumulated deep AI expertise and routinely publish world-class research, creating a flywheel that attracts other top AI talent.

Apple Intelligence, by contrast, has struggled. John Gruber, an influential writer and podcaster, captured the sentiment in his critical piece “Something Is Rotten in the State of Cupertino.” Google has competitive models with Gemini and can even outline a compelling vision for the OS AI layer, but organizational dysfunction has prevented Android from shipping a cohesive one. This dysfunction reminds me of that old joke about Google promising to make messaging simple again with yet another chat application (Google Talk, Google Hangouts, Android Messages, Google+ Messenger, Huddle, Google Allo, Duo, Google Voice, Google Chat, Google Meet; did I miss any?).

Structurally, though, Operating Systems are better positioned8.

They have system-level access to all apps on the device, so they can operate across multiple apps to finish a task, something a ChatGPT cannot do.

They have access to personal data across messages, photos, calendar, and location that any individual application cannot match.

They have a distribution advantage since they can ship to current devices via software updates and can come pre-installed on future ones.

So Amazon may be able to block Perplexity from intermediating users, but will they block Siri when Apple does the same?

I suppose, in a way, this is the “Everything App/Super App” that Chinese companies pioneered finally reaching Western markets, realized through the operating system rather than a single application.

The Chinese Dark Horse

Speaking of China, a new entrant from Beijing suggests that the pursuit of OS AI will not be an American-only affair.

Earlier this week, ByteDance unveiled a demo of their Doubao Phone Assistant, a Graphical User Interface (GUI) based OS AI that takes a different approach. Instead of relying on system-level hooks, it uses multimodal understanding of screen content to enable cross-app device control via simulated tapping, swiping, and typing. This direct interpretation means it can theoretically operate inside any app, including those the device has never seen before and with or without explicit developer cooperation. Apple Intelligence lacks this capability because it, as of now, requires apps to implement in advance the App Intents framework mentioned earlier. The demo showed price comparison across multiple retailers, car control integration with Tesla, and other agentic tasks.

From a market perspective, the parallels to the automotive industry are striking. Legacy US and European automakers once dismissed Chinese electric vehicles (EV) as cheap knockoffs9. But now Chinese EVs are capturing market share across Europe by competing both on price and quality/performance/features10. Tariffs and regulatory barriers have kept Chinese EVs out of the US market for now11.

Similarly, Chinese personal device manufacturers are currently dismissed as copycats12. But with their novel and ambitious OS AI efforts, proven open-source AI models such as DeepSeek, and lower cost structure, they could soon compete both on capability and cost. If that happens, the US will likely have to impose restrictions on these Chinese AI devices just as it has on Chinese cars and telecom equipment. But can the US influence the rest of the world to adopt American OS AI if ByteDance/Doubao or something like it proves superior at lower costs? Your guess is as good as mine.

Application Layer’s Strategic Choice

Every product that lives on the application layer faces a similar question to the one Amazon’s leadership faced fifteen years ago as they see a similar chart in their business reviews.

The Verge, a tech news website, notes that CEOs of companies in the application layer such as Uber, DoorDash, Airbnb, and Lyft all believe their accumulated advantages (supply networks, operational know-how, brand loyalty etc.) will protect them from this new AI intermediary (quotes slightly edited for better readability/context):

Brian Chesky (Airbnb CEO): There’s this AI maximalist view that there’s going to be like one or two AI models and one or two applications that rule them all and you use this one app and this one model for everything in the world. If you take that to its logical conclusion, you also start to go to this place where almost one company rules everything, and I think there’s numerous problems with the AI maximalist view that it’s one company to rule them all. I don’t think companies just want to be data layers, and so these platforms or these new interfaces are only as good as the companies that participate, and the companies will only participate if they can have a relationship with their own customer.

Dara Khosrowshahi (Uber CEO): As it relates to AI and these agents, we want to work with these players. We come from a place of strength because of the unique inventory and the fragmentation of these markets that we’re organizing. People spend so much time trying to figure out what the economics might be when the first thing is to try it out. Figure out the experience first and then the economics. Once you optimize the experience, we can measure. Are you an incremental consumer for Uber or are you totally cannibalistic? If it’s cannibalistic, then I’m going to charge a lot of money. If it is incremental, then I would pay some take rate. Is it a 5, 10, or 20 percent take rate? It depends on the incrementality.

Ania Smith (Taskrabbit CEO): Siri, in this case, wants to be able to provide these types of services, and they can’t really do it without Taskrabbit because only Taskrabbit actually has a network of thousands of Taskers. We cultivated that network. We know who they are and we understand their skills. They’ve all been background checked. Siri, Apple, or whoever is not going to do that.

Amazon’s lawsuit against Perplexity suggests they don’t share this view. Fifteen years ago, facing similar concerns, Amazon tried to build its own device. That device failed, but Amazon’s e-commerce business continued to thrive by accepting its position on the application layer and optimizing within those constraints. They refused to sell digital content through mobile apps and continued to invest in the customer experiences that App Store didn’t tax.

Just as Amazon’s leadership once saw personal devices as a way to escape the App Store tax, some AI companies (notably OpenAI) believe they too must make a personal computing device to own the user relationship. Besides the obvious belief that AI-native companies like themselves can design AI personal devices better than today’s device makers can, they don’t want to live at the mercy of Operating Systems. They don’t want to ask Cupertino for permission13. They want to own their own destiny.

Disclosure: I worked at Amazon from 2014-2024, but was not involved in personal device discussions.

If you enjoyed this post, please consider sharing it on your socials or with someone who might also find it interesting. You can follow me on Twitter/X or LinkedIn for more frequent business and tech discussions.

Under the wholesale model, Amazon paid publishers a fixed price for ebooks and set its own retail price, often selling $9.99 bestsellers at a loss to drive Kindle adoption. When Apple launched iBooks in 2010, it adopted the agency model (where publishers set prices and Apple takes 30%), then tried to force Amazon to do the same. The US Department of Justice (DOJ) later successfully sued Apple and five publishers for price-fixing conspiracy.

While publications such as Fast Company attribute the Fire Phone project to concerns over App Store fees, Amazon has never publicly confirmed this reasoning. In the book Working Backwards, former Amazon executives Colin Bryar and Bill Carr recount how Amazon’s earlier personal device initiative (Kindle) originated from similar strategic concerns. The catalyst was a 2003 meeting between Jeff Bezos and Steve Jobs, where Jobs demonstrated iTunes for Windows, and suggested Amazon would become “the last place to buy CDs.” This prompted Bezos to build an Amazon-controlled digital reading platform before Apple or others could dominate ebooks.

Apple’s policies prohibited developers (until May 2025) from directing users to alternative/cheaper payment options not just in their apps but across their websites, support docs, emails/newsletters, and any other communication with customers.

This “partner with non-market leaders strategy” to enter markets mirrors Apple’s iPhone launch with second-placed carriers (AT&T instead of Verizon in the US, SoftBank instead of NTT DoCoMo Japan). The theory is that the second and third placed players are willing to cede control for market access, while the market leader typically tries to dictate terms.

I think the current AI chatbot shopping experiences lack visual UX that is on par or better than the native shopping app. The technology might get there eventually with generative UI, but until then they will remain a small fraction of how people shop.

The irony of yet another example of food delivery, restaurant reservation, or travel booking AI agent is not lost on me.

This applies most directly to transactional apps such as food delivery or ride hailing, where the value is in the outcome rather than the interface. Games, media, or productivity apps will likely remain experience destinations where the app itself delivers value.

Apple’s on-device models currently underperform cloud-based foundation models, forcing Apple Intelligence to use a three-tier system of local on-device processing, private cloud compute, and third-party partnerships such as Gemini or ChatGPT. Apple is betting that on-device models will eventually handle most queries well enough to eliminate per-query costs and external dependencies. I think users will accept local models for basic tasks like summarizing, but they will seek the best available intelligence for complex actions, which means cloud models will continue to be important for complex reasoning.

Chinese EVs made up 10% of EV sales in Europe in 2023; UBS, a bank, predicts China’s share of all cars sold in Europe could hit 20% by 2030. Economist, 2024.

Sheel Mohnot, X/Twitter, 2025